AMPEFI has partnered with Affirm to offer our customers easy, affordable financing for your engine management system needs!

Instant approval, no hidden fees or surprises. See below for more information and frequently asked questions.

Choose 3, 6, or 12 Monthly Payments

CLICK HERE to Prequalify Now

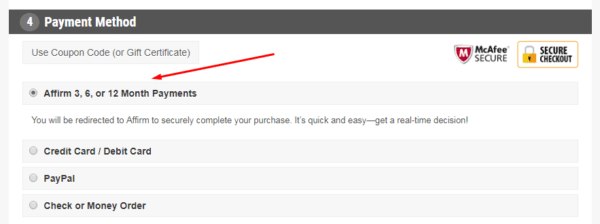

How to make a purchase with Affirm:

- Shop with AMPEFI –

Place the items you’d like to purchase in your cart. - Qualify with Affirm –

Select “Affirm 3, 6, or 12 Month Payments” at checkout, provide the required information, and get a decision in real-time. - Get yo’ goodies!

FAQ

What is Affirm?

Affirm is a financing alternative to credit cards and other credit-payment products. Affirm offers instant financing for online purchases to be paid in fixed monthly installments over 3, 6, or 12 months.

Why buy with Affirm?

- Buy and receive your purchase right away, and pay for it over several months. This payment option allows you to split the price of your purchase into fixed payment amounts that fit your monthly budget.

- If Affirm approves your loan, you’ll see your loan terms before you make your purchase. See exactly how much you owe each month, the number of payments you must make, and the total amount of interest you’ll pay over the course of the loan. There are no hidden fees.

- The application process is secure and real-time. Affirm asks you for a few pieces of information. After you provide this information, Affirm notifies you of the loan amount that you’re approved for, the interest rate, and the number of months that you have to pay off your loan — all within seconds.

- You don’t need a credit card to make a purchase. Affirm lends to the merchant directly on your behalf.

- You may be eligible for Affirm financing even if you don’t have an extensive credit history. Affirm bases its loan decision not only on your credit score, but also on several other data points about you.

- Affirm reminds you by email and SMS before your upcoming payment is due. Enable Autopay to schedule automatic monthly payments on your loan.

How does Affirm approve borrowers for loans? What is required to pre-qualify?

Your Affirm account is created using your name, email, mobile phone number, birthday, and the last 4 digits of your SSN. This combination helps Affirm verify and protect your identity.

- Affirm asks for a few pieces of personal information: Name, email address, mobile phone number, date of birth, and the last four digits of your social security number.

- Affirm verifies your identity with this information and makes an instant loan decision.

- Affirm bases its loan decision not only on your credit score, but also on several other data points. This means that you may be able to obtain financing from Affirm even if don’t have an extensive credit history.

Does Affirm perform a credit check? Does it impact my credit score?

When you first create an Affirm account, Affirm performs a ‘soft’ credit check to help verify your identity and determine your eligibility for financing. This ‘soft’ credit check will not affect your credit score.

Is my personal information secure with Affirm?

Yes, protecting your personal information is very important to Affirm. Affirm encrypt sensitive data including Social Security numbers. Affirm also maintains physical, electronic, and procedural safeguards to protect your information. Affirm does not sell or rent your information to anyone.

How does Affirm work?

Affirm loan-application process steps:

- At checkout, choose Pay with Affirm.

- Affirm prompts you to enter a few pieces of information: Name, email, mobile phone number, date of birth, and the last four digits of your social security number. This information must be consistent and your own.

- To ensure that you’re the person making the purchase, Affirm sends a text message to your cell phone with a unique authorization code.

- Enter the authorization code into the application form. Within a few seconds, Affirm notifies you of the loan amount you’re approved for, the interest rate, and the number of months you have to pay off your loan. You have the option to pay off your loan over three, six, or twelve months. Affirm states the amount of your fixed, monthly payments and the total amount of interest you’ll pay over the course of the loan.

- To accept Affirm’s financing offer, click Confirm Loan and you’re done.

After your purchase, you’ll receive monthly email and SMS reminders about your upcoming payments. You can also set up autopay to avoid missing a payment. Your first monthly payment is due 30 days from the date that we (the merchant) processes your order.

What is required to have an Affirm account?

To sign up for Affirm, you must:

- Be 18 years or older (19 years or older in Alabama or if you’re a ward of the state in Nebraska).

- Not be a resident of Iowa (IA) or West Virginia (WV).

- Provide a valid U.S. or APO/FPO/DPO home address.

- Provide a valid U.S. mobile or VoIP number and agree to receive SMS text messages. The phone account must be registered in your name.

- Provide your full name, email address, date of birth, and the last 4 digits of your social security number to help us verify your identity.

Why can’t customers outside of the U.S. use Affirm?

Affirm is available only to shoppers residing in the United States. Affirm hopes to expand its services to customers outside the U.S. in the future.

*Subject to credit check and approval, and a down payment may be

required. Payment options depend on your purchase amount. Affirm loans

are made by Cross River Bank, Member FDIC.